Why do we need Bitcoin?

Looking around in society today, it does not take long before you find someone feeling lost or depressed about the way the world is heading. This may even be you, feeling as if you are constantly trying to move forward but some invisible force is holding you back. It is like walking through treacle or running on the never-ending hamster wheel.

One of the biggest causes of this is money. Many of us have never considered what money is beyond simply trying to earn it, save it and spend it on the things we need. Money, however, is inherent in how we organise together as humans so when it becomes corrupted the effects are felt in every aspect of society and our lives.

Study the face of a young person today and a sense of hopelessness can often be seen. It used to be that if you worked hard, applied yourself and put your skills to good use, life would reward these endeavours. Today, however, the incentive to work, to save for a house and to think about the future has been absolutely obliterated by an invisible force, one that cannot be voted against; the problem of inflation.

The Inflation Problem

Mainstream economics would suggest that inflation happens when a representative bag of goods, chosen by the powers that be, increases in price. This is known as the consumer price index (CPI) and can easily be manipulated based on the goods you put in the basket or the way it is measured. Price increases can occur for numerous reasons including, shortages, supply chain issues or sudden increases in demand, but they are not necessarily inflation.

Genuine inflation happens when the money supply is increased through a combination of government borrowing, money printing and quantitative easing by a central bank. As more and more new money is introduced into an economy, the purchasing power of the money you hold reduces. Traditionally, most central banks have aimed to keep this inflation at 2% claiming this was necessary for a healthy economy. However, as inflation rates in many western nations now reach 10%, it becomes very obvious that inflation is theft.

A Game of Monopoly

Imagine you and I are playing a game of monopoly. We have been playing together for 2 hours. It began as a free market where we had equal opportunity to spend money and buy assets. I got lucky though and ended up owning 85% of the properties. You are close to being completely bankrupt, but I am winning. I’m winning so well; I don’t want the game to end. So rather than letting you go bankrupt, I instead manipulate the game. Now every time you pass “Go” you get £500 instead of £200, increasing the money supply and inflating the currency. You’re initially happy with this because it allows you to continue and not go bankrupt. The problem is I own all the property and all the businesses. On your next three rolls that entire £500 has transferred from you, a person just trying to survive, to me, a person rich in both cash and assets like property and businesses. Next time round we increase the supply again, so you now receive £800 for passing go. The game goes on and on, with you getting poorer and me getting richer. The game is rigged.

When banks crashed in 2008, they were ‘too big to fail’ so were bailed out and the liabilities those banks held were taken on by the national economies through the printing of vast quantities of new money and taking on unfathomable amounts of debt. Initially, this might have seemed like a good idea but, in reality, we just pushed the problem into the future. Then followed, particularly in the public sector, years of frozen pay rises (or 1% rises) whilst inflation fluctuated between 2% and 4%. Each year, people like me, a police officer at the time, were getting worse off as part of government austerity measures. This inflated money supply meant the following years were just like the monopoly game; if you owned a house, equities or other assets, you did very well, but the majority suffered and saving became pointless.

Then 2020 arrived, along with a global crisis. Whatever your thoughts around the pandemic, it resulted in another colossal increase in the money supply and borrowing. Combine this with price increases caused by Brexit, supply chain issues, an energy crisis, and Putin invading Ukraine, and we end up in the shocking situation we are in today – where many of us are worried about how we will heat our homes and feed our families this winter.

Central banks now have two choices. Keep interest rates low and let inflation continue. Or raise interest rates and, thanks to the extraordinary amount of debt, create the biggest recession in living memory and implode the entire system. Tim Watkins from the ‘Consciousness of Sheep’ writes beautifully about this. With UK debt now well over 2 trillion pounds and standing at over 100% of GDP, debasing the currency through inflation is the only way to keep the whole corrupted system running. The longer this continues, the worse the inevitable crash will be, resulting in very real-world consequences.

A Finite Environment

If all of this does not sound bad enough, we then introduce the environmental factor into the conversation where the inflationary money system demands “growth” forever in business and in national and global economies. Again, it sounds obvious, but in a world of finite resources, this is simply not possible.

Inflated money and cheap credit have spread worldwide and created, at least in the West, levels of comfort and consumerism we have never seen before. This could only happen because we had the energy to do so in the form of oil, which powered the global economy from top to bottom. As economies grew, so did their insatiable appetite for oil. The majority of us were part of it as we demanded bigger, better and cheaper – everything from TVs and mobile phones to fancy holidays and copious amounts of food.

Regardless, eventually the wheels are going to fall off and we find ourselves in a time where we face a crisis with the big three – energy, economy and environment. Energy is at the heart of this story and everything we do.

In recent months we have heard from the left on numerous occasions calling for so-called “degrowth”. Using degrowth to mean ‘reducing consumerism’ is no bad thing, but once we dig into these arguments, we usually find no real solution other than suggestions to use less energy. This fundamentally misses the point. In truth, we need to use more energy. For any economy to flourish and the people within it to prosper, firstly there needs to be an input of cheap and abundant energy. Others talk of a sustainable ‘circular’ economy. Kate Raworth has produced a thesis called ‘doughnut economics’ where human flourishing continues to improve, but the economy operates sustainably with each part of the system acting in symbiosis. It sounds brilliant but, so far, I have not heard her talk about how the base money layer will work to enable such a system. With the current inflationary money we have today, it can never work because it is a system that demands growth forever.

Human Rights

This is where the story gets deeply depressing. I will start by pointing to the work of the Human Rights Foundation and Alex Gladstein, who wrote a book titled ‘Check Your Financial Privilege’. The central thesis of the book is that many Westerners immediately dismiss the potential of Bitcoin because we are financially privileged and have grown up in countries with; stable economies, liberal democracies, functioning legal systems, strong currencies and with access to financial services like credit and banking. The vast majority of the world are not in this fortunate position – Alex Gladstein writes,

“Only 13% of our planet’s population is born into the dollar, euro, Japanese yen, British pound, Australian dollar, Canadian dollar or Swiss franc. The other 87% are born into autocracy or considerably less trustworthy currencies. As of December 2021, 4.3 billion people live under authoritarianism, and 1.6 billion people live under double or triple-digit inflation.”

“Critics in the dollar bubble miss the bigger global picture. Anyone with access to the internet can now participate in bitcoin, a new money system with; equal rules for all participants, running on a network that does not sensor nor discriminate, used by individuals who do not need to show a passport or an ID and held by citizens in a way that is hard to confiscate and impossible to debase. So while Western headlines focus on Coinbase going public, Tesla buying billions of dollars worth of bitcoin and ‘tech bros’ getting fabulously rich, there is a quiet revolution happening worldwide. Until now, governments and corporations have controlled the rules of money. That is changing.”

Throughout my investigations and this journey, which I have travelled for a few years now, the most deeply disturbing revelation is that everything we enjoy today has come at the cost of most other people on the planet. Everything from: children working in the cobalt mines of the Congo to make batteries; suicidal factory workers making your iPhone; Uighur slaves making solar panels; and the dreadful conditions and long hours many people work for us to enjoy coffee, chocolate and sugar. The dollar system backed by the IMF and the World Bank has been truly devastating for so many people in poor countries. Aside from war, these institutions have operated a kind of economic colonialism, saddling countries with debt that can never be repaid to ensure their produce and resources flow back to the West.

Gladstein writes of Bangladesh in a recent essay, “with financing from the World Bank and IMF, countless farms and their surrounding wetlands and mangrove forests were engineered into shrimp ponds known as ghers. The area’s Ganges River delta is an incredibly fertile place, home to the Sundarbans, the world’s biggest stretch of mangrove forest. But as a result of commercial shrimp farming becoming the region’s main economic activity, 45% of the mangroves have been cut away, leaving millions of people exposed to the 10-meter waves that can crash against the coast during major cyclones. Arable land and river life have been slowly destroyed by excess salinity leaking in from the sea. Entire forests have vanished as shrimp farming has killed much of the area’s vegetation, “rendering this once bountiful land into a watery desert,” according to Coastal Development Partnership.”

The World Bank and IMF have often also spread their influence by supporting brutal regimes in those countries that are not afraid to persecute their own or other people.

“Hence, the IMF prefers to work with undemocratic clients who can more easily dismiss troublesome judges and put down street protests. According to Payer, the military coups in Brazil in 1964, Turkey in 1960, Indonesia in 1966, Argentina in 1966 and the Philippines in 1972 were examples of IMF-opposed leaders being forcibly replaced by IMF-friendly ones. Even if the Fund wasn’t directly involved in the coup, in each of these cases, it arrived enthusiastically a few days, weeks or months later to help the new regime implement structural adjustment.”

“The Bank and Fund share a willingness to support abusive governments. Perhaps surprisingly, it was the Bank that started the tradition. According to development researcher Kevin Danaher, “the Bank’s sad record of supporting military regimes and governments that openly violated human rights began on August 7th, 1947, with a $195 million reconstruction loan to the Netherlands. Seventeen days before the Bank approved the loan, the Netherlands had unleashed a war against anti-colonialist nationalists in its huge overseas empire in the East Indies, which had already declared its independence as the Republic of Indonesia.”

This is why I believe Bitcoin provides hope for humanity. Bitcoin is ‘ground up’ technology, and people in countries like Nigeria, Sudan, Ethiopia, Cuba and Afghanistan intrinsically understand why it matters. It brings hope and an ability to maintain their value in the face of banking being closed down, governments stealing their money, violent gangs taking everything they have and the ravages of war destroying entire countries. By being self-sovereign and holding the keys to your bitcoin – just 12 or 24 words that you can memorise in your mind – a person can retain, relocate or rebuild with the ability to access their funds anywhere in the world.

What is Bitcoin?

Bitcoin is digital cash and was launched in the wake of the financial crash of 2008. The evolution of digital cash ran side by side with the development of the internet, and numerous attempts were made to implement it that ultimately failed. Some failed because they were centrally controlled and could therefore be taken down by authorities. However, one of the biggest problems was the double spend. Double spending is an issue with digital cash where an attempt could be made to spend the same coin more than once. Without a central controlling authority to prevent this, solving this problem in a decentralised system was key.

Bitcoin was invented by a person from the “cypherpunk” community known by the handle “Satoshi Nakamoto” and, prior to its launch, released a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System”.

“A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution. Digital signatures provide part of the solution, but the main benefits are lost if a trusted third party is still required to prevent double-spending. We propose a solution to the double-spending problem using a peer-to-peer network. The network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work.”

The chain described above is now more commonly known as the blockchain, but it is basically just an ever-growing ledger of transactions. That ledger is then distributed to anyone who wants to run a bitcoin node, and when new transactions are added (or timestamped) to the chain, through the process known as mining, each node can easily verify the transactions because it is a system built on cryptographic proof. The necessity for trust is therefore removed.

Satoshi writes, “Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments. While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the trust-based model. Completely non-reversible transactions are not really possible since financial institutions cannot avoid mediating disputes.”

“With the possibility of reversal, the need for trust spreads. Merchants must be wary of their customers, hassling them for more information than they would otherwise need. A certain percentage of fraud is accepted as unavoidable. These costs and payment uncertainties can be avoided in person by using physical currency, but no mechanism exists to make payments over a communications channel without a trusted party.

What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.”

What this did was basically put truth and honesty into the heart of Bitcoin using code. The current fiat system of money is based on trust. That trust, as detailed above, has been abused. Bitcoin incentivises good behaviour. When a new block of transactions is added to the chain, the computer that correctly discovered the cryptographic proof is rewarded with new coins. This is known as the “block reward”. As the network has grown, more computers (or miners) now compete to discover each new block, and this makes the network more secure. It, therefore, becomes more profitable to support the network honestly than to try and attack it.

The system is secure as long as honest nodes collectively control more CPU power than any cooperating group of attacker nodes.

Bitcoin is peer-to-peer cash operating on a decentralised network with no single user having any greater rights over another. It, therefore, means transactions are permission-less, cannot be censored by bad actors or authoritarian regimes, no bank is required and anyone with a phone and an internet connection can participate. This brings financial hope and freedom to billions of people where previously none existed.

What is Money?

Money is not as easy to define as we might think because it is basically a system at the heart of how we cooperate as humans. My belief is that it is a form of communication that acts as a future claim on energy. You do a thing today that earns you money; we all agree it has value, which allows you to spend it in future on a product or service that requires energy to produce.

The money we use today such as dollars or pounds is often referred to as “fiat” currency. This is where currency is not backed by any kind of physical commodity such as gold, silver or oil. It is only backed by the government issuing it and is therefore no more than a paper IOU where the value depends on the stability of a country and the strength of its economy.

A widely held theory in economics is that money must have three properties. It must be a:

- Store of value

- Medium of exchange

- Unit of account

Think of current fiat money in your country like dollars or pounds. Almost everything you buy or sell is priced in this currency because it gives us a point of reference about how much something is worth – it is a unit of account.

If you were to take the time producing a particularly nice photograph and print it into a beautifully crafted piece of artwork, there is a good chance I will want to buy it. So I offer you £1000 for it, which you accept, and we complete the transaction. Pounds have acted as our medium of exchange.

You are a prudent person, so you decide to save the £1000 because next year you are planning your dream holiday to the Maldives. It is now acting as a way for you to transmit your value into the future – it is a store of value.

The problem is fiat currencies are now starting to fail at holding these properties. With inflation currently around 10%, the purchasing power of your money reduces, and it is no longer very good at all as a store of value. The insidious nature of inflation encourages consumerism because today you have £1000 that could buy a new iPhone. But if you wait, next year it will cost £1100, and you won’t be able to afford it anymore. This perverse incentive runs throughout global economics and leads to short-term thinking, poverty for the poorest, a requirement for constant growth and environmental destruction as we consume everything in sight to maintain that growth.

In certain countries with weak currencies such as Venezuela, Turkey and Argentina, there are many people who now refuse to trade with those currencies, preferring dollars, so they no longer act as a medium of exchange. As a result, it is not long after that they stop being a unit of account or fail altogether.

Bitcoin has only just entered its teenage years but has already been acting as a store of value for millions of people despite its price volatility (see below). It is now widely used as a medium of exchange, including by me, where you can buy prints and books with bitcoin or donate it as part of the value for value model under which this site operates.

There are also now many people who have taken the final step onto the ‘bitcoin standard’ by also using it as a unit of account.

As Bitcoin grows and becomes more widely adopted, all three of these properties will grow stronger.

21 Million

One of the main properties of bitcoin is that there is a finite supply. There will only ever be 21 million bitcoin. Currently, there have been about 19.2 million coins created with new ones entering the network every time a block is produced. Initially, this may sound problematic because there would never be enough to go around, but each individual bitcoin contains 100,000,000 smaller units known as sats (short for Satoshi). Sats are like the pennies to the pound.

What this does is create a deflationary money that increases its value and purchasing power over time. Economists and politicians will often argue that inflationary money is required to drive growth and the velocity of money, but we are in this mess in large part due to those people. A deflationary money system would increase long-term thinking, decrease consumerism and drive the kind of sustainable future we need. Bitcoin can also provide the velocity of money via a second layer known as Lightning (see below).

Let’s use wages as an example offered by Jeff Booth. As described above, wages since 2008 have been sticky, either being frozen altogether or remaining below inflation, so people are worse off each year. With bitcoin as deflationary money, however, wages could remain sticky but instead, each year, you become better off as purchasing power of bitcoin increases.

The same property of bitcoin also encourages saving because its value increase over time. For example, you could buy a PlayStation today, but if you waited for 5 years, that same amount of bitcoin might buy a PlayStation and a guitar. It is for this reason consumerism would reduce, a certain amount of “degrowth” would occur, and we would only be incentivised to produce, make and buy products and services that deliver genuine value or last a long time. How much pointless plastic crap have you received as a Christmas gift or thrown away in the last ten years?

It would also offer hope for young people, especially those with deprived upbringings. Having the ability to graft, work hard and commit to a long-term plan to save for a better life in the future has been wiped out by the current fiat money system. Bitcoin restores these positive incentives. The website bitcoin or shit is a fun site that hammers the point home by giving examples of how much money you’d have if you had saved bitcoin instead of buying pointless shit.

Bitcoin is beautiful

Not long after starting to investigate Bitcoin, I began to regard it as beautiful. This was mainly due to it being a ground-up technology, incentivising honest behaviour and offering hope to the world. However, once I looked more closely at how block rewards work and the “halvening” occurs, I became convinced it is beautiful.

When Satoshi mined the first bitcoin block, he was rewarded with 50 bitcoins (BTC). Every block for the next four years also came with a 50 BTC reward. Then on November 28th 2012, the first “halvening” occurred when the block reward was reduced to 25 BTC per block. This system was baked into the code from day 1. It was reduced again in 2016 to 12.5 BTC and today sits at 6.25 BTC. The next “halvening” is due to occur around March 29th, 2024, at block height 840,000 when the reward will be reduced to 3.125 BTC.

The reason for the “halvening” is a beautiful piece of design that exists to aid the scarcity of bitcoin so there will only ever be 21 million BTC. When bitcoin was new and had very few users, the reward was large so a good number of coins were available to be used in the early days. As adoption grows, the amount of new coins entering the system reduces and it is this that gives bitcoin its deflationary properties. So, if I save 100,000 sats today, it will be worth more in the future because scarcity increases.

Looking at the halving more closely, it felt eerily familiar. Then it struck me; Fibonacci. The Fibonacci sequence is a string of numbers where the previous two numbers make the next number in the sequence, i.e., 0,1,1,2,3,5,8,13,21 etc., etc. This is an astonishing sequence that shows up in nature on numerous occasions in the form of the golden spiral, such as a snail shell, a sunflower or the spiral of a hurricane. As many photographers will know, the golden spiral can be used to compose a photograph and has been used in many famous artworks and architectural designs.

What is interesting about Bitcoin is that not only was the block reward 50BTC for the first four years, but also 50% of the total 21 million supply came into circulation. During the four years that the block reward was 25 BTC, 25% of the 21 Million was produced. This trend continues right until the final fraction of a bitcoin is produced around the year 2140. Plotting these numbers into a graphic, I realised the golden spiral exists at the heart of Bitcoin. It truly is a thing of beauty. I genuinely believe Bitcoin is one of the keys to a prosperous future for humanity in all areas, including energy, the economy, and the environment.

Lightning

One of the criticisms often directed towards Bitcoin is that it is slow. Completing around 2500 transactions every ten minutes, it gets nowhere near the scale to be able to support total global transactions. Bitcoin is slow by design in order to remain secure and decentralised. However, what many miss is that everything we have discussed so far refers to the base layer of Bitcoin.

The traditional financial system is also layered. When you purchase a bag of shopping at the grocery store using your credit card, this does not result in a final settlement. There are multiple layers and messages going back and forth between the banks, payment processors, visa and Mastercard etc. Final settlement may not occur until days or weeks after the actual transaction. The whole system is obfuscated and often complex because the money does not really exist and banks operate a system built on fractional reserve, where they loan out a lot more money than they actually have. It really is a house of cards that could collapse at any time.

By contrast, the Bitcoin base layer is a rock-solid foundation. Its ability to act as a medium of exchange and complete thousands of transactions a second is provided by a layer 2 system called Lightning. This operates a little bit like visa and a payment processor combined but also provides instant final settlement. Lightning is bitcoin, so you still spend sats. Payment is made by the receiver, or point of sale, generating a QR code; you then open a wallet on a phone or tap a supported card and the peer-to-peer transaction completes instantly and virtually for free, unlike the 3% fee many credit providers charge.

The Lightning network also provides velocity of money that many fear a deflationary money system destroys. This is discussed by Jeff Booth in this podcast – click here

Investopedia defines velocity of money as:

“The velocity of money is a measurement of the rate at which money is exchanged in an economy. It is the number of times that money moves from one entity to another. The velocity of money also refers to how much a unit of currency is used in a given period of time. Simply put, it’s the rate at which consumers and businesses in an economy collectively spend money.”

For the average bitcoin user in the future, it is very likely they will never need to worry about layers or lightning. Instead, we will simply transact with bitcoin using well-developed wallets and services without ever having to worry about what is happening under the hood.

Isn’t Bitcoin bad for the environment?

For many, this is the thing that jumps into peoples’ minds when they think about bitcoin. As a landscape photographer, who cares so deeply about nature and the environment this premise is especially important to me – and as such I have spent considerable time investigating it.

Firstly we might consider a base philosophy. Should we be judging each other for the energy or electricity we use and pay for? If so, then who decides on correct use? It would quickly become a virtue signalling race to the bottom that stifles innovation and something draconian governments could take advantage of through the use of “carbon credits”, digital ID’s and CBDC’s to restrict our movement; activities; what we produce; and what we buy.

Bitcoin mining machines use electricity. They do not emit carbon dioxide or any other pollutant and they do not devastate landscapes to dig bitcoin out of the ground.

Unfortunately, there has been a campaign against Bitcoin by the undemocratic centralised powers that it is designed to replace. If you have heard, “Bitcoin is bad for the environment and uses the same amount of power as [insert any small country]”, there is a 99% probability this is sourced from widely discredited articles created by Alex DeVries, who just so happens to work for the Dutch Central Bank. Despite this, Bitcoin does use a lot of electricity. But this is a feature, not a bug, and it is still a fraction of the power used in other industries that, unlike Bitcoin, provide little to no hope for the world.

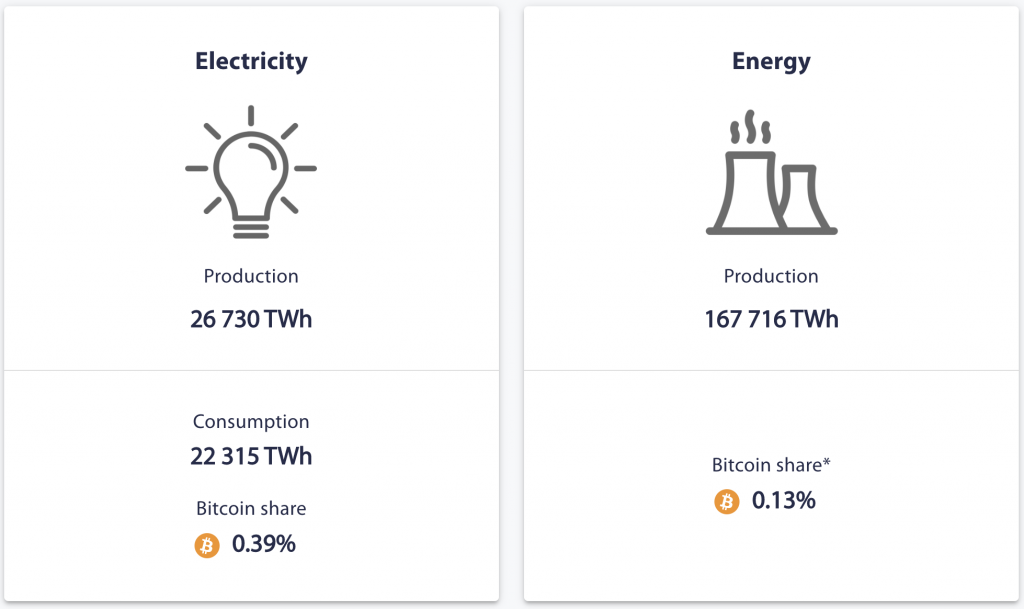

These graphics are provided in research conducted by the University of Cambridge into the energy use of the Bitcoin network. Considering what bitcoin can offer humanity and with the potential to become a world currency, for me, 0.13% of the world’s energy seems reasonable.

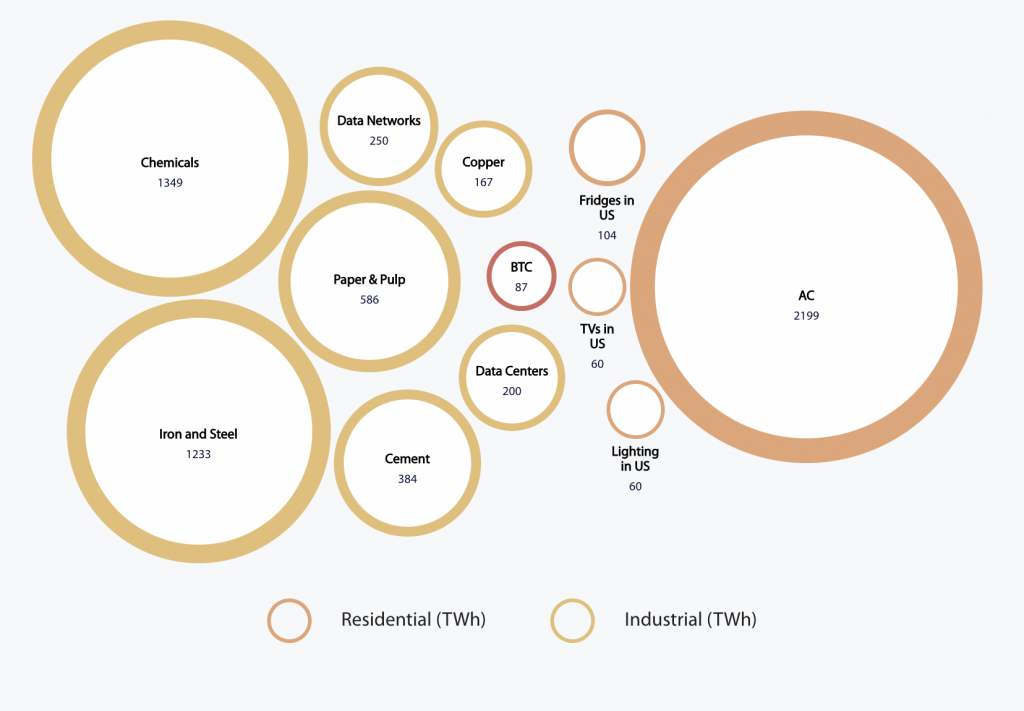

The graphic below shows Bitcoin’s energy usage compared to domestic and non-domestic activities that, although mostly unrelated, are similarly energy intensive.

Update Jun 2022 – The Cambridge research is now out of date and vastly overestimates the amount of energy generated using fossil fuels, including the amount of mining taking place in Kazakhstan which has dropped significantly.

The extensive work carried out by Daniel Batten provides the most up to date research detailing bitcoin mining energy use – read more here.

Proof of Work

In order for Bitcoin to be decentralised, censorship-resistant, incorruptible and peer-to-peer money, it uses a process known as proof of work. This is where a computer uses the Sha256 algorithm to timestamp thousands of transactions into a block using very strict cryptography, which prevents double spending of coins, and it can then very easily be verified on the network. However, anyone running a mining machine is competing to find this block at the same time, basically by guessing thousands of times a second. The algorithm then occasionally adjusts the difficulty, depending on how many machines are competing, so only one block is produced about every ten minutes. As the difficulty adjustment makes this more and more difficult, increasing amounts of electricity are required. (See here for or why proof-of-stake is NOT a better option.)

Bitcoin miners are almost never competing for electricity or preventing anyone else from using the power. The reason for this is price. It is an extremely competitive market, and if bitcoin miners had to pay the same price as we do for our domestic electricity, they would go out of business very rapidly. Philosopher Troy Cross describes bitcoin miners as “dung beetles” because they are looking and searching around for the cheapest and most worthless electricity imaginable that would otherwise be wasted, and it is often stranded without a connection to the grid. As of December 2022, an estimated 52.8% of the energy used for bitcoin mining was off grid, using predominantly zero-emission power sources (see here).

A staggering amount of electrical energy is wasted each year because it is not often generated at the time or the place where it is required for consumption. Wind turbines, for example, can create a large amount of electricity, but when they blow all night, whilst people are asleep and demand is very low, that energy will go wasted. At this moment in time, battery technology is still nowhere near the capacity required to stabilise a grid and is also extremely expensive. However, I remain hopeful for Sodium battery technology to improve.

A Shit Show

One example of where bitcoin mining is actually reducing carbon emissions comes from a beautiful farm in County Armagh in Northwest Ireland. Here they are collecting the waste from cows and other organic matter and feeding it into an anaerobic digester. This runs a process that turns the waste into biogas and digestate that can be used, amongst other things, as fertiliser. The biogas produced is then used to produce electricity to power the bitcoin miners. They are literally turning shit into bitcoin.

The resulting bitcoin makes this a profitable operation where otherwise it may not have been, as costs increase for storing and transporting the gas. This way, the bitcoin mining machines are on site, and the biogas is used immediately. Instead of Methane being released into the atmosphere directly from cows and their waste, now only carbon dioxide is released. Methane is much worse for the atmosphere than CO2, and removing it in this way is known as methane mitigation. Indeed, the UN has acknowledged that even though CO2 is still released, this is considered a carbon-negative practice. This is because, in the atmosphere, Methane hangs around for a lot longer, increasing the greenhouse effect before it breaks down into CO2 anyway.

The Methane Problem

Methane is currently released into the atmosphere as a result of numerous processes we rely on including oil production, landfill sights and numerous natural sources. The traditional way to mitigate this methane has been to set it alight to create a flare. In perfectly still weather conditions this will convert about 98% of the methane into CO2. In windy conditions, however, this figure drops significantly which often goes unreported. However, installing a generator and bitcoin miners on sight, immediately burning the gas and using the resulting electricity, this figure can reach almost 100% of methane converted; a net positive for the environment.

The fact that bitcoin miners are, in effect, just number-guessing machines they are relatively simple and can therefore be moved around and set up in new locations very quickly, often in a simple shipping container. They will therefore continue to hunt out the energy that no one else wants and is on course to be one of the first ever entirely carbon-negative industries.

The speed at which bitcoin mining is transforming ground up projects using stranded energy is simply staggering. With the additional revenue from bitcoin, capital investment and operational expenditure becomes viable in projects that would otherwise have been deemed too risky to invest in. A very interesting example of this is companies bringing new renewable power generation to parts of Africa where previously there were none (see here). Just this last week the first Africa Bitcoin conference took place with numerous stories emerging of how bitcoin is empowering and raising people up in Africa (see more on Twitter).

This is all before the next halving in 2024 too. This is when the payment awarded to miners for discovering a block, reduces from 6.25 bitcoins to 3.125. Profits from bitcoin mining are literally cut in half. At this point, the challenges faced by mining companies become even more intense, where only the ones using the cheapest and cleanest energy will survive.

A Rebel Alliance

One fascinating property of Bitcoin is it attracts interest from across the political spectrum. Everyone from hardcore American Libertarians and anarchists who want no government at all, to people who are members of Extinction Rebellion. This includes BlueRabbit Alarmist on Twitter who has created the website https://www.bitcoinpowerconsumption.info/climate.html which is a great resource if you are interested in how bitcoin can help the environment.

Bitcoin really is for everyone.

Isn’t Bitcoin just a Ponzi scheme?

No.

Bitcoin in no way meets the definition of a Ponzi. Bitcoin is a mesh, not a pyramid. There is no one at the top to benefit like in a Ponzi. Ponzi schemes are also short-lived. Bitcoin has now been around for over 12 years and remains resilient to attack plus a wide range of market forces affecting macroeconomics more widely. Bitcoin is a new monetary system that provides genuine hope for humanity and cannot be “debased by national or international debt or the whimsy of politicians” – Cosmo Crixter.

Bitcoin does, however, show ‘network effects’ where every new person who joins the network benefits the existing members. It behaves like a positive feedback loop or a snowball turning into a snowman.

Well-respected macroeconomist Lyn Alden provides the clearest explanation of why bitcoin is not a Ponzi scheme – read more here

Isn’t bitcoin too volatile?

Vijay Boyapati frames this best in his must-read article “The Bullish Case for Bitcoin”,

“Bitcoin’s price volatility is a function of its nascency. In the first few years of its existence, Bitcoin behaved like a penny-stock, and any large buyer — such as the Winklevoss twins — could cause a large spike in its price. As adoption and liquidity have increased over the years, Bitcoin’s volatility has decreased commensurately. When Bitcoin achieves the market capitalisation of gold, it will display a similar level of volatility. As Bitcoin surpasses the market capitalisation of gold, its volatility will decrease to a level that will make it suitable as a widely used medium of exchange.”

Isn’t bitcoin for money laundering and criminals?

No. Have you seen money laundering that goes on in the fiat world? Even the banks do it.

But the answer is also yes. There is a saying, “bitcoin is for enemies.”

The point is – it is for everyone. It’s like the internet, email, telephone lines or basically any other publicly available protocol you can think of; it does not discriminate. Would you really want someone deciding who is right or wrong or guilty or innocent at the money layer? If so, who would you hand the keys for control to? Personally, that thought scares me which is why I am so opposed to central bank digital currencies (CBDCs).

Bitcoin not “Crypto”

You may have noticed that not once in this article, until now, have I used the phrase “crypto currency”. “Crypto” or “crypto currencies” are terms you hear about a lot in the mainstream media, and bitcoin is often lumped together with them to create a negative feeling. There are literally tens of thousands of other “cryptos” and not a single one of them is worthy of attention. There is only bitcoin.

Bitcoin is designed to be an open source and decentralised network, meaning that anyone can look at the source code and change it to create something similar. This was vital to maintain the core principles of Bitcoin, but it has meant that numerous “cryptos” sprang up in its wake, often with huge amounts of funding from Silicon Valley venture capitalists such as A16Z.

One you may have heard of is called Ethereum, made famous by being the platform for NFTs. This was well funded by Venture Capitalists (VCs) and, prior to it becoming a public asset, the owners and engineers rewarded themselves with a huge amount of coins in what is known as a pre-mine. These are essentially coins created out of thin air before the proof-of-work mining began adding new transactions to the block chain. It was then the job of the VCs and the Ethereum Foundation to market and promote the ETH coins by creating a set of problems that they claimed Ethereum solved. The most famous were NFTs and DeFi (decentralised finance).

The NFT Scam

I have written and talked extensively about why I believe NFTs are a scam. The initial interest was understandable though because they tugged on artists’ heartstrings, including my own, because they promised to solve the problem of monetising digital content. More recently, I have come to believe that, because of the deflationary nature of technology, the price of digital content will always trend to zero. That is why this site exists with a value-for-value model, and it is also why NFTs are doomed to fail. Digital content can be copied easily for free and for an infinite number of times and, with that scarcity gone, the price falls forever. NFTs tried to create an artificial scarcity and, once that bubble burst, they all crashed to zero.

DeFi was another use case, and it has feverish support from many in the “crypto industry”. The problem is that all of “DeFi” is built on systems that themselves are not decentralised, including Ethereum. At the moment in the US, lawmakers are looking heavily at this. It is likely that most “cryptos” will be classified as Securities, which means they would be fully regulated and controlled and remove any benefit they claim to provide in the first place. Bitcoin, however, does not meet the Howey Test and at the moment is classed as a commodity like gold or oil. In future it should be classed as a sovereign currency, as it is in El Salvador already, which would exempt it from capital gains tax. Bitcoin also cannot be regulated because it is completely decentralised and becoming more so every day as more people run their own nodes and mining becomes more diverse. Bitcoin does not have a CEO, a marketing budget, a team or company and no one is employed by Bitcoin. Bitcoin developers mostly work either on their own, for free, through the generosity of donations or by working for companies that produce Bitcoin related products like wallet software.

The marketing teams of so-called “cryptos” have done a very effective job of obfuscating what bitcoin does. They use phrases like “blockchain technology”, “distributed network”, and “crypto” to suggest bitcoin has some good features but it doesn’t work well enough, so we need their product to fix it. There is only bitcoin worthy of attention. The blockchain fixes the base money layer acting as an ever-expanding ledger. The slow, 10 minute speed of each block is by design because it allows for faultless security and decentralisation. All the problems that numerous “crypto” companies claim are solved by “blockchain” technology would be better solved with a normal database. They only use a blockchain to pretend they are not centralised. Solana was a very, very popular one and this can be turned off and on at the whim of those in control. You can’t turn bitcoin off.

Opposing Goals

The main goal of bitcoin was to be digital cash and solve the problems we discussed above. It is aiming to be a global currency where it acts as a store of value, a medium of exchange and a unit of account. The progress it has made toward this goal in just 12 years is frankly an astounding achievement.

The main goal of “crypto”, however, is murky. Often by copying the bitcoin source code, these coins were created and backed by VCs essentially as an unregulated security where the founders run a classic “pump and dump”. This is where they employ celebrities to advertise their “crypto”, talk about how amazing it is, get rappers to sing about their monkey jpegs and encourage retail investors and smaller funds to buy their token. The price skyrockets and then once the VCs have made a 100x (sometimes even a 1000x) return, they dump all their coins onto the market which then sends the price crashing. Then everyone loses their money if they sell, or the token simply disappears.

There are worse scams too that happen in the “crypto” industry, such as the recent collapse of the exchange, FTX, run by Wall Street and Washington DC sweetheart Sam Bankman-Fried. He basically spent a lot of time verbally attacking bitcoin but ended up losing 8 billion dollars of customers’ funds in what is potentially one of the biggest frauds of all time. He has yet to face any charges or jail time. One has to wonder what his massive donations to the political elite bought him.

Unlike all other “crypto”, Bitcoin is a ground-up technology that was designed to provide the world with a better money that could not be manipulated or inflated. It is no wonder then, that the powerful elite who benefit most from the current corrupted money system hate it so much and are doing all they can to promote that “bitcoin is bad” or just for “crypto bros”. Just recently, a representative of Ripple Labs, creator of the XRP token and working closely with banks and governments, paid Greenpeace USA around $5 million to run a campaign called “Change the Code”. This states that bitcoin should change from proof of work to a system that uses less energy called proof-of-stake.

Proof-of-Stake: A worse version of the current system

The problem with proof-of-stake is it is basically a reproduction, and probably more evil version, of the current system where all the biggest stakeholders benefit the most at the cost of those at the bottom. Ethereum recently switched to proof-of-stake, and to be able to participate, you would need to run a node that requires a high-end machine and stake at least 32 ETH (around $41,000 today). Unsurprisingly, the trend for Ethereum will be to become more and more centralised over time. What has also happened is that most Ethereum nodes are also now OFAC compliant, meaning transactions can and will be censored by the US government. In its current state, Ethereum looks more like the system that will run Central Bank Digital Currencies, an invention of pure evil.

Bitcoin, by contrast, benefits everyone. Just holding some bitcoin, you begin to benefit from the system. Whether you hold 10,000 BTC or just 0.0001BTC, neither has greater control over the network. By running a small Raspberry Pi with a 1TB hard drive, you can maintain your own copy of the entire Bitcoin blockchain and verify transactions yourself. In addition, at the current time, Bitmain S9 miners can be bought for as little as £150, and if you could find a cheap enough energy source (water wheel, large solar array, etc.), you could participate in mining and be profitable. You could even plug one into the wall at home, although, with current electric prices, it probably would not be profitable, but it would also heat your home. However, they’re pretty noisy so a DIY soundproof box may be required too.

Personally, I believe the trend will be for many smaller electrical devices to mine bitcoin on a micro scale when not doing their main task. If everyone was mining with 1TH at home, that would make the bitcoin network incomparably decentralised.

The recently aired Star Wars series Andor was a brilliant and thrilling story about the birth of a rebellion. However, whilst I am sure this rings true with activists who partake in more traditional protests, after well over a thousand hours of study and investigation, it is hard not to believe that Bitcoin is the real revolution…… and a peaceful one at that.

Thanks for reading……..

As you made it to the end please consider supporting my work. This site operates on a value-for-value model and is funded by your donations to keep it free of ads, sponsorships, clickbait and subscription based paywalls. Alternatively you can support me by buying a book or a fine art print to adorn your wall. If now is not the right moment to part with your hard earned pennies, why not instead contribute a little of your time by sharing the article on social media. Don’t forget to tag me in and say hi.

Give Value BackReferences and Source Material

Vijay Boyapati

Kate Raworth

Alex Gladstien

- STRUCTURAL ADJUSTMENT: HOW THE IMF AND WORLD BANK REPRESS POOR COUNTRIES AND FUNNEL THEIR RESOURCES TO RICH ONES click here.

- Check Your Financial Privilege

Tim Watkins

- https://consciousnessofsheep.co.uk/ – Energy, Economy, Environment

University Of Cambridge

Jeff Booth

- https://amzn.to/3VIYenb – Price of Tomorrow

Other

- https://www.bitcoinpowerconsumption.info/climate.html – written by a member of Extinction Rebellion